A Strong Start to 2025—Despite Seasonal Headwinds

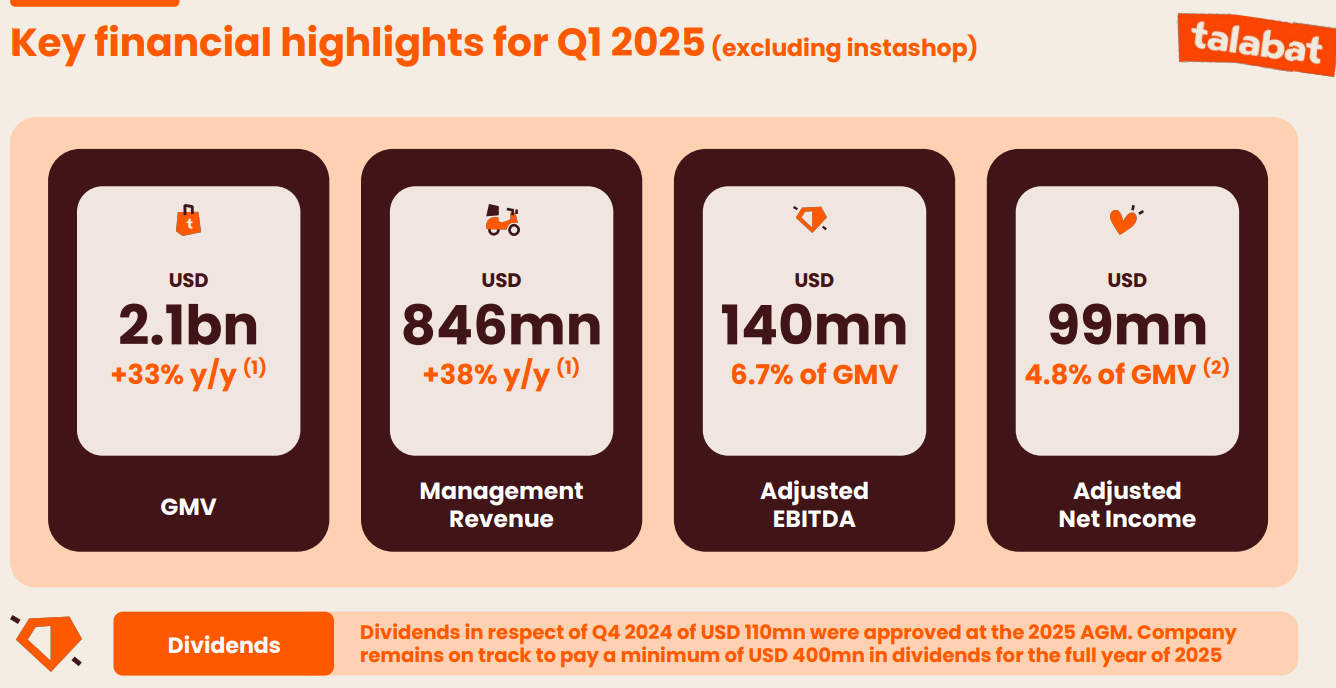

Talabat Holding, the MENA region’s leading on-demand delivery platform, posted a stellar performance in Q1 2025, reinforcing its dominance across food and grocery verticals. Despite Ramadan, historically a season of softened food delivery demand, Q1 saw a 33% year-on-year rise in gross merchandise value (GMV) on a constant-currency basis, touching an impressive $2.1 billion.

This performance not only highlights Talabat’s operational agility but also reflects structural changes in consumer behavior and digital adoption in the Middle East and North Africa. Ramadan, once a predictable dip in order frequency, has now become a manageable curve, thanks to Talabat’s evolving product mix and smart seasonal strategies.

Top-Line Growth Across the Board

- Revenue rose 38% year-over-year (constant currency) to $846 million, outpacing GMV growth and indicating stronger monetization across orders.

- Net income grew nearly fourfold to $103 million, driven in part by revenue scale and operational efficiencies.

- On an adjusted basis (excluding non-recurring items), net income came in at $99 million, or 4.8% of GMV.

- Adjusted EBITDA rose 34% to $140 million, equating to a healthy 6.7% EBITDA margin, an encouraging sign for a sector often criticized for thin profitability.

What’s remarkable here is the consistent expansion across multiple dimensions, GMV, margins, and bottom-line results. Talabat seems to be breaking the “growth-at-all-costs” mold and demonstrating that scale and profitability can co-exist, even in the highly competitive q-commerce space.

Vertical and Regional Growth in Harmony

Growth wasn’t isolated to a single geography or product. Both GCC markets (UAE, Kuwait, Qatar, Bahrain, Oman) and non-GCC markets (Egypt, Jordan, Iraq) contributed meaningfully to the quarter’s success. The geographic GMV mix held steady at 84% GCC and 16% non-GCC, but Egypt in particular showed promising traction, becoming a key growth engine.

From a vertical perspective, Talabat saw strong growth in both its traditional Food business and the Grocery & Retail (G&R) segment. Importantly, the G&R vertical, often considered harder to scale due to logistical complexity, has now become a third of the overall GMV when accounting for Instashop, Talabat’s newly acquired subsidiary.

This diversification is more than just a revenue hedge; it’s a strategic evolution. By moving beyond restaurants and deepening its reach into household essentials, Talabat is increasing order frequency, boosting average basket size, and unlocking stronger customer retention.

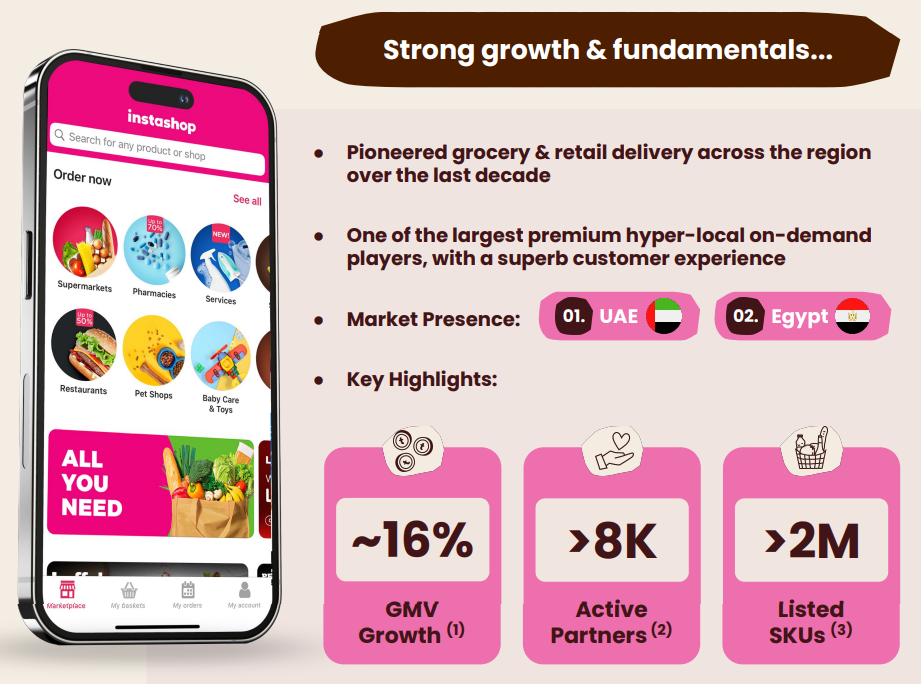

The Instashop Advantage: Complementary, Not Redundant

In Q1, Talabat completed the acquisition of Instashop, a hyper-local grocery delivery pioneer in the region. The move is proving to be strategically sound. Despite overlapping markets, customer bases are largely distinct: only 32% of Instashop users also used Talabat’s G&R services. This complementary overlap allows for meaningful cross-sell opportunities without cannibalizing existing demand.

Instashop posted $173 million in GMV (up 16% YoY at constant currency), along with a 2.0% EBITDA margin, an impressive number for a newly acquired unit. Talabat expects significant cost and revenue synergies in the coming quarters, suggesting margin improvement is just beginning.

Moreover, Instashop brings with it over 2 million SKUs and more than 8,000 active retail partners, significantly strengthening Talabat’s fulfillment and vendor relationships in the retail space. Together, they are well-positioned to dominate the evolving q-commerce landscape.

Seasonal Volatility Now a Thing of the Past?

One of the more understated wins of the quarter was Talabat’s ability to reduce seasonal volatility, particularly during Ramadan. Since 2023, the company has brought down Ramadan-driven order volume drops by ~40%, a feat enabled by deeper G&R adoption and smarter inventory and promotional planning.

This operational agility means Talabat can now deliver more predictable quarter-on-quarter performance, making it an increasingly attractive investment and a reliable partner for vendors and advertisers alike.

Strategic Initiatives Fueling Momentum

A key part of Talabat’s sustained growth is its multi-pronged innovation strategy, including:

- AdTech revenue streams through platform-based advertising

- Strategic partnerships with CPG brands

- Expansion of talabat Kitchens and DineOut offerings

- Rollout of the talabat Pro loyalty program, especially successful in Egypt

- Continued investment in FinTech integrations, allowing for smoother payments and upsell potential

These initiatives are not just boosting topline numbers, they’re embedding Talabat more deeply into users’ everyday lives.

FY 2025 Outlook: Is There Room for an Upgrade?

Talabat’s full-year guidance (excluding Instashop) forecasts:

- 17-18% GMV growth

- 18-20% revenue growth

- 6.5-7.0% adjusted EBITDA margin

Given the Q1 overperformance (GMV up 33%, revenue up 38%, EBITDA margin at 6.7%), these targets seem conservative. If momentum holds, Talabat may revise guidance upward, a move that would further excite markets and investors.

Additionally, the company is on track to distribute a minimum of $400 million in dividends, with $110 million already approved for Q4 2024, a clear sign of balance sheet strength and confidence in cash generation.

What It Means for MENA’s Digital Economy

Talabat’s Q1 success is a bellwether for the broader MENA tech ecosystem. Here’s why it matters:

- Proof of profitability in q-commerce, a traditionally cash-intensive sector

- Validation of Egypt and Iraq as fast-growing digital markets

- Demonstration of acquisition synergy with Instashop, showcasing M&A maturity

- Sign of maturing consumer behavior, with higher frequency, basket size, and loyalty

Talabat’s performance also sends a strong signal to investors and global tech giants: MENA is no longer a “future opportunity”, it’s a current growth engine, especially in digital consumer services.

Final Thoughts

Talabat is transitioning from a growth-stage disruptor to a mature platform business with a clear playbook for profitability, scale, and ecosystem expansion. Its Q1 2025 results reveal a company that is executing sharply, expanding wisely, and capitalizing on favorable demographic and economic trends in the MENA region.

As the region’s digital economy deepens, Talabat isn’t just riding the wave, it’s helping shape it.