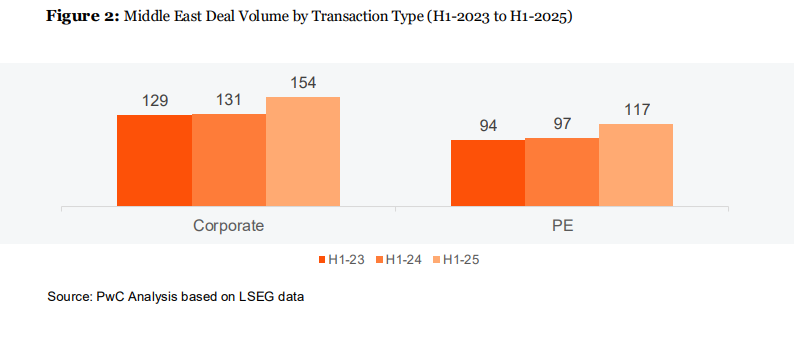

In a world of macroeconomic uncertainty, geopolitical fragmentation, and cautious capital, a surprising narrative of growth and strategic ambition is unfolding. While global M&A volumes contracted by 9% in the first half of 2025, the Middle East and North Africa (MENA) region defied the trend, recording a robust 271 deals, a 19% increase year-over-year.

This isn’t a story of reckless speculation or a bubble. It’s a calculated, sovereign-led transformation of the entire regional economy. This is creating a powerful tailwind for entrepreneurs, startups, and the investors who back them. The latest PwC TransAct Mid-Year Update is more than a report on mergers and acquisitions; it’s a blueprint for where capital, innovation, and opportunity are converging in the MENAP region.

The Great Reorientation – Inward Focus for Global Ambition

The most striking trend is the decisive pivot towards intra-regional and domestic deals, which reached 134 transactions in H1 2025. This stands in stark contrast to outbound activity, which has fallen to 96 deals from 141 just two years prior. This isn’t a retreat from the world stage; it’s a strategic consolidation of home turf.

For the startup ecosystem, this signals a critical shift. Regional investors, particularly the region’s powerful Sovereign Wealth Funds (SWFs), are no longer just limited partners in Silicon Valley funds. They are now the lead architects of a new economic reality, actively building “local champions” and scaling critical sectors from within.

What this means for VCs and Entrepreneurs: The funding thesis has evolved. The most compelling pitch is no longer just about disrupting a local market; it’s about how your startup aligns with a national priority. Can your fintech platform enhance financial inclusion and digital sovereignty? Does your cleantech solution support a Gulf state’s 2030 decarbonization goals? Does your B2B SaaS company strengthen supply chain localization? If the answer is yes, you are operating in a zone of strategic importance with access to unprecedented capital and regulatory support.

The Rise of the Strategic Mid-Market Deal

A deeper dive into the numbers reveals a crucial nuance: this boom is not driven by headline-grabbing megadeals. In fact, 96% of all disclosed transactions were under $100 million, and there were no deals above $5 billion for the second consecutive year.

This “mid-market dominance” is a golden signal for the venture capital and growth-stage startup community. It reflects a market that prizes agility, strategic fit, and capital efficiency over sheer scale. Investors are prioritizing targeted acquisitions that:

- Are easier to finance in a high-interest-rate environment.

- Close faster, reducing execution risk.

- Offer complementary capabilities or technologies to existing platforms.

- Are less exposed to valuation volatility.

For entrepreneurs, this means exit opportunities are becoming more numerous and accessible. The path is no longer solely towards a blockbuster IPO or a massive international acquisition. Instead, strategic acquisitions by regional corporates or SWF-backed entities for sums in the tens or hundreds of millions are becoming a realistic and attractive liquidity event.

Sector Deep Dive – Where the Smart Money is Flowing

The PwC report highlights several sectors experiencing intense activity, each telling a story about the region’s future.

1. Technology, Media & Telecommunications (TMT): The Infrastructure Play

The region’s tech focus has matured dramatically. The largest deal of H1 2025 was the $2.2 billion transaction where G42 acquired a larger stake in Khazna Data Centers. This, coupled with Saudi Arabia’s monumental $100 billion AI fund, signifies a pivotal shift from consumer-tech buzz to the hard, foundational assets of the digital age: data centers, cloud capacity, and AI infrastructure.

Impact on Startups: The message is clear: B2B is king. Startups building enterprise-grade AI solutions, cybersecurity, data analytics, and IoT platforms for industries like energy, logistics, and healthcare are perfectly positioned. The sovereign mandate to build “digital sovereignty” creates a massive, protected market for homegrown tech providers.

2. Financial Services: The Digital Engine

Financial Services was the most active sector, with ~70 deals in H1 2025. The action is in fintech, driven by payments, alternative lending, and embedded finance. Egypt’s Qardy completing the region’s first fintech SPAC merger and cross-border insurance acquisitions highlight a sector in rapid, digitally-fueled consolidation.

Impact on Startups: The fintech revolution is entering its next phase. Opportunities abound not just in consumer apps, but in the underlying infrastructure: regulatory tech (RegTech), wealth tech, and B2B financial services that help businesses navigate new tax and localization reforms. The integration of finance into other verticals (e.g., edtech, healthtech) also opens doors for embedded finance startups.

3. Healthcare: Consolidation and Scalability

Healthcare deal activity remained steady, anchored by two massive Saudi IPOs (Almoosa and Specialized Medical Company, raising nearly $1 billion combined) and ongoing consolidation, like Burjeel’s acquisitions in the UAE. This reflects strong demand for scaled, efficient healthcare providers.

Impact on Startups: The focus is on scalability and operational efficiency. Startups that offer telehealth platforms, hospital management software, diagnostic AI, or innovative pharma supply chain solutions can partner with or become attractive acquisition targets for these scaling healthcare giants. The push to “localise pharma” also creates opportunities in biotech and manufacturing.

4. Industrial Manufacturing & Automotive (IMA): Localization in Action

This sector saw significant activity, driven by Vision 2030 and similar agendas. Deals like Ma’aden’s $964 million acquisition of a stake in Aluminium Bahrain are about securing strategic industrial inputs. The issuance of 83 new industrial licenses in Saudi Arabia in a single month shows the sheer velocity of this build-out.

Impact on Startups: This is a call to action for “hard tech” and Industry 4.0. Startups in advanced manufacturing, robotics, supply chain logistics, and sustainability tech (e.g., green hydrogen, carbon capture) are operating at the heart of the region’s economic transformation. The need to make energy-intensive industries more efficient and less carbon-heavy is a monumental challenge that innovation can solve.

Country Spotlights – The Power Trio and Beyond

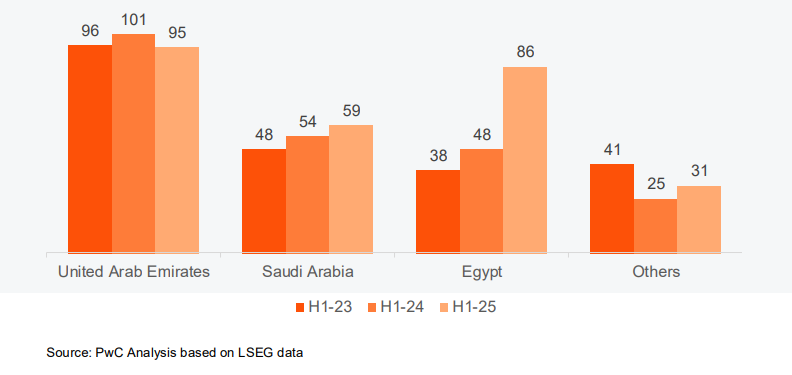

The UAE (95 deals), Saudi Arabia (59 deals), and Egypt (86 deals, a stunning 79% YoY increase) account for 89% of all regional activity.

- The UAE continues to leverage its regulatory clarity and deep capital markets to act as the region’s premier transactional hub, especially for cross-border and tech deals.

- Saudi Arabia is the engine of domestic transformation. Its deals are overwhelmingly strategic, state-aligned, and focused on building national champions in line with Vision 2030. High CEO confidence (77% expect growth) fuels this momentum.

- Egypt’s remarkable rebound, powered by an IMF program and massive Gulf investment, shows its resilience and vast potential. For VCs, it represents a large, underserved market with a talented population, now back on the radar of major regional capital.

Looking Ahead – A Playbook for the Future

The second half of 2025 is set to continue these trends. Domestic and intra-regional deals will dominate. Mid-market transactions in digital infrastructure, green industry, and healthcare will be the primary vehicles for growth.

For the key players in the ecosystem, the playbook is clear:

- For Entrepreneurs: Align your mission with a national vision. Think B2B, infrastructure, and scalability. Position your company as a strategic asset in the region’s transformation. The path to exit is now more diversified, consider acquisition by a regional corporate as a primary goal.

- For Venture Capitalists: The investment thesis must incorporate sovereign strategy. Due diligence should now include an analysis of “strategic fit” with regional goals. The most promising portfolio companies will be those that can easily be acquired to fill a capability gap for a large, scaling corporate or sovereign-backed entity.

- For International Investors: The MENAP region is no longer a peripheral market. It is a strategic play in itself, characterized by immense capital deployment, rapid regulatory reform, and a clear vision for the future. Partnering with local funds and understanding the nuances of each market’s agenda is critical to success.

The Middle East is not immune to global pressures, but it is uniquely equipped to navigate them. Armed with sovereign capital, a clear vision, and an increasing appetite for the agile and strategic, the region is actively building its future, one mid-market deal at a time. For those with the insight to read the map, the opportunities have never been greater.