In a bold move set to reshape digital payments in the Gulf, EazyPay and Tamara have announced a strategic partnership to enhance the Buy Now, Pay Later (BNPL) experience. This collaboration promises to streamline checkouts, improve transaction security, and set a new benchmark in the region’s fast-evolving digital commerce ecosystem.

A Fintech Alliance With Purpose

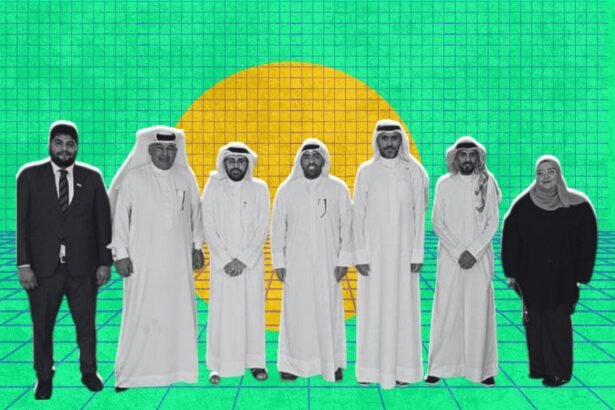

The partnership officially launched in Manama, Bahrain, where EazyPay, one of the country’s most trusted fintech providers, was confirmed as the local acquirer for Tamara. Known for its flexible BNPL solutions, Tamara has rapidly grown across the GCC. This new tie-up could significantly speed up its regional expansion.

Together, the two fintech players are working to build:

- Smoother checkout experiences for online and in-store purchases

- Secure and reliable transactions backed by local infrastructure

- Stronger merchant support through innovative payment options

- Flexible payment solutions that customers already trust and prefer

This collaboration goes beyond technical integration. It’s about making digital payments easier, faster, and more accessible for both merchants and consumers.

Why This Matters for Gulf Consumers

BNPL is gaining serious traction across the Gulf, but it’s not without its challenges. Delays in checkout, unclear repayment terms, and weak local infrastructure have often left users frustrated. That’s where this partnership makes a difference.

- Tamara brings in proven expertise in flexible payments and customer experience.

- EazyPay contributes robust local knowledge and a well-established payment gateway.

Together, they aim to remove the friction from the checkout process. In addition, they aim to enhance the overall user journey from cart to confirmation. With both companies focused on security, transparency, and speed, consumers can expect a more reliable way to pay over time, without the usual hiccups.

A Shared Vision for Regional Impact

Both leaders have voiced their strong support for the partnership. Nayef Tawfiq Al Alawi, CEO and founder of EazyPay, described Tamara as “a trusted choice” for flexible payments, and emphasized that the alliance will deliver “a smoother, faster, and more reliable payment experience.”

On the other side, Faris Al Obaid, CEO of Tamara Bahrain, called the deal “thrilling” and pointed to the importance of local partnerships in accelerating Tamara’s Gulf expansion. His focus on regional relevance suggests a long-term plan to go beyond Bahrain and scale Tamara’s presence across the GCC.

The Road Ahead

This partnership isn’t just about easing payments, it’s about building trust, reducing drop-off rates at checkout, and empowering local businesses and startups with better payment tools.

- ✅ Faster checkouts

- ✅ Stronger security

- ✅ Better customer retention

- ✅ Regional scalability

Whether it lives up to its full potential remains to be seen, but the foundation is solid. If successful, EazyPay and Tamara could redefine what BNPL looks like across the Gulf, raising the bar for fintech in the region.