In a major boost for sustainable and inclusive finance, Beltone Leasing and Factoring, a subsidiary of Beltone Holding, has secured a $20 million funding agreement. The funds come from two major global impact investors, SANAD Fund for MSME and the Green for Growth Fund (GGF), and are set to support key sectors across the MENA region.

The deal is split evenly between the two funds, with each contributing $10 million. Both are managed by Germany-based impact asset manager Finance in Motion GmbH.

A Dual Approach to Economic Empowerment

This funding goes beyond capital. It reflects a strong vote of confidence in Beltone’s strategy to support:

- Micro, small, and medium enterprises (MSMEs)

- Financial inclusion for underserved communities

- Green energy projects and sustainability efforts

The SANAD Fund’s share will go towards empowering MSMEs and low-income households. This is crucial, as MSMEs are the economic backbone of many MENA economies. Helps in generating jobs, promoting innovation, and boosting local resilience.

On the other side, the Green for Growth Fund (GGF) will use its investment to promote:

- Renewable energy initiatives

- Energy efficiency improvements

- Sustainable resource management

As global attention intensifies on climate action, this funding positions Beltone as a key player in driving environmentally responsible finance in the region.

Strengthening Financial Foundations

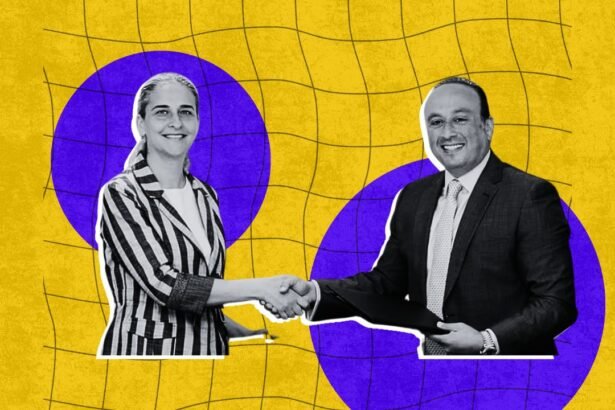

Amir Ghannam, Deputy Head of NBFIs for Leasing, Factoring, and Consumer Finance at Beltone, stressed the importance of this partnership. He pointed out that foreign currency funding from institutions like SANAD and GGF helps Beltone diversify capital sources and enhance competitiveness.

“This deal allows us to support MSMEs more efficiently and fast-track green projects, crucial elements for building a resilient financial ecosystem,” said Ghannam.

Similarly, Sherif Hassan, Group Treasurer and MD of Debt Capital Markets, noted that the agreement is a clear reflection of Beltone’s ESG commitment. He called it a strong collaboration with Finance in Motion.

A Regional Financial Powerhouse

For those unfamiliar, Beltone has evolved into one of the MENA region’s leading financial groups, offering services in:

- Brokerage and asset management

- Real estate finance

- Consumer lending

- Venture capital solutions

Beltone’s multi-sector presence has enabled it to support both traditional and tech-driven sectors. This makes it a go-to partner for sustainable growth.

Impact that Matters

The SANAD Fund, backed by institutions like Germany’s KfW and Switzerland’s SECO, has a strong track record of supporting employment-driven projects and enhancing financial access. Meanwhile, GGF continues to push for a low-carbon future in MENA and beyond, working closely with both public and private sector partners.

Final Thoughts

In a time of global uncertainty, this $20 million investment is a reminder that confidence in MENA’s potential remains strong. With the right capital and partnerships, companies like Beltone are helping turn challenges into opportunities, for entrepreneurs, communities, and the climate.