Pakistan’s Startup Ecosystem at a Crossroads

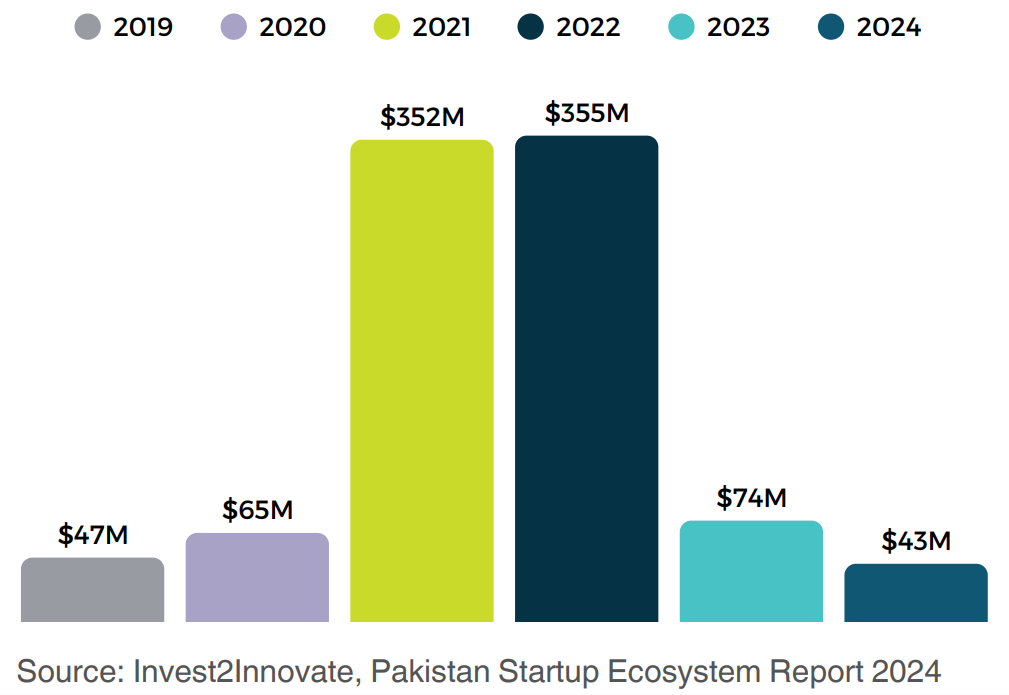

Pakistan’s startup ecosystem has witnessed rapid growth over the past decade, fueled by a young, tech-savvy population, increasing digitization, and a wave of entrepreneurial energy addressing local and regional challenges. National Incubation Centers alone have supported 1,950+ startups, creating 183,000+ jobs, a testament to the sector’s economic potential. However, this momentum is under threat. Venture funding in Pakistan plummeted by 88%, from $355 million in 2022 to just $43 million in 2024, exposing deep structural barriers that stifle innovation and growth.

This policy brief, co-authored by Invest2Innovate (i2i), Telenor, and the Special Technology Zones Authority (STZA), presents a roadmap to revitalize Pakistan’s startup ecosystem by addressing regulatory hurdles, expanding funding avenues, and strengthening support structures. For entrepreneurs, investors, and policymakers, these insights are critical for understanding the challenges and opportunities in Pakistan, and the broader MENA and Pakistan (MENAP) region.

The State of Pakistan’s Startup Ecosystem – Growth and Challenges

1- The Rise and Sudden Decline of Startup Funding

Pakistan’s startup ecosystem saw a surge in venture capital between 2019 and 2022, peaking at $355 million in 2022. Key sectors driving this growth included:

- FinTech ($527M)

- E-commerce ($577M)

- Logistics & Mobility ($441M)

- EdTech ($133M)

However, funding collapsed in 2023-24, mirroring global trends but exacerbated by local instability:

- Currency depreciation & inflation

- Internet shutdowns & political uncertainty

- Regulatory bottlenecks

This sharp decline highlights the fragility of Pakistan’s investment climate and the urgent need for reforms to retain capital and talent.

2- Why Startups Fail – The Funding Gap and Regulatory Barriers

A staggering 73% of incubated startups fail to secure funding within two years, primarily due to:

- Heavy compliance burdens (e.g., multi-agency filings, conflicting tax laws)

- Limited access to diverse funding (banks demand collateral; IP-backed lending is underdeveloped)

- Foreign investment hurdles (complex repatriation rules, MoI approvals for foreign shareholders)

- Weak exit pathways (stringent IPO requirements, high GEM Board thresholds)

Without intervention, Pakistan risks losing high-potential startups to offshore jurisdictions like the UAE and Singapore, where regulatory environments are more startup-friendly.

Key Policy Recommendations – A Blueprint for Reform

The policy brief outlines four priority areas to unlock capital and drive sustainable grow

1- Regulatory & Tax Reforms – Reducing Early-Stage Friction

Problem: Startups face one-size-fits-all corporate compliance rules, conflicting tax definitions, and bureaucratic delays.

Solutions

- Create a “startup class” with simplified filings (e.g., no AGMs, CDC exemptions for first 5 years).

- Harmonize startup definitions across tax and financial laws (e.g., align with Companies Act 2017).

- Extend tax holidays (3-year exemption, followed by a 5-10% flat tax for years 4-5).

- Standardize provincial sales tax at 2% to prevent double taxation.

- Exempt startups from withholding tax for 5 years to ease cash flow.

Impact: Lower compliance costs could keep startups onshore and encourage formalization.

2- Expanding Funding Options – Unlocking Domestic & Foreign Capital

Problem: Traditional financing (bank loans) is inaccessible, while angel investors and VCs face tax disincentives.

Solutions

- Enable IP-backed lending (SECP valuation standards + Ignite’s 50% loan guarantee pilot).

- Simplify private fund licensing (reduce approval time from 8-12 months to 3-4 months).

- Remove the 50-investor cap on private funds to attract more angels.

- Introduce regulatory sandboxes for micro-VCs (like Singapore’s MAS framework).

- Recognize modern financing instruments (SAFEs, convertible notes, revenue-based financing).

- Tax incentives for investors (30% angel tax credit, 7-year VC exemptions).

Impact: These changes could diversify funding sources and attract foreign capital.

3- Creating Liquidity & Exit Pathways via Capital Markets

Problem: Startups struggle to exit due to high IPO thresholds (PKR 25M for GEM Board).

Solutions

- Lower GEM Board entry to PKR 10M to help early-stage startups go public.

- Ease IPO profitability requirements (remove 2-year profitability mandate).

Impact: More startups could access public markets, providing liquidity for early investors.

4- Strengthening the Entrepreneurial Support Ecosystem

Problem: 73% of incubated startups fail to raise funding due to poor investment readiness.

Solutions

- Shift from cohort-based to tailored startup support (sector-specific mentorship).

- Expand subsidized legal & IP services via NICs and STZA.

- Establish ESO-government working groups to streamline incentives.

- Tax credits for ESOs (20% of operating costs) to improve sustainability.

Impact: A stronger support system could increase startup survival rates.

Broader Implications for the MENAP Region

Pakistan’s challenges are not unique, many MENA and South Asian startups face similar hurdles:

- Regulatory fragmentation (e.g., UAE’s multiple free zone rules).

- Limited early-stage funding (Saudi Arabia and Egypt also rely heavily on government-backed funds).

- Weak exit markets (few regional startups IPO locally; most target NASDAQ or ADX).

However, Pakistan’s reforms could set a precedent for the region:

- Regulatory sandboxes (like UAE’s DIFC FinTech Sandbox).

- Tax incentives for investors (similar to Saudi Arabia’s SME investment deductions).

- Digital startup-investor matchmaking (scaling models like Bahrain’s Tenmou).

If successful, Pakistan could emerge as a competitive startup hub, attracting capital from GCC investors looking for high-growth markets.

A Call to Action for Policymakers & Investors

Pakistan’s startup ecosystem is at a make-or-break moment. Without reforms:

- More startups will relocate offshore.

- Local investors will remain hesitant.

- Job creation and tech innovation will stall.

But with bold, coordinated action, Pakistan can:

- ✅ Retain high-potential startups by cutting red tape.

- ✅ Unlock domestic and foreign capital through investor-friendly policies.

- ✅ Build a sustainable innovation economy with strong support systems.

For VCs and angel investors, Pakistan offers untapped opportunities, especially in FinTech, e-commerce, and logistics, but regulatory improvements are key to de-risking investments.

To entrepreneurs, the message is clear: advocate for these reforms while leveraging existing incentives (e.g., STZA tax exemptions).

For policymakers, the time to act is now, before the funding gap becomes irreversible.

Final Thought – A Regional Opportunity

Pakistan’s reforms could inspire similar changes across MENAP, creating a more interconnected, investor-friendly startup landscape. The question is: Will Pakistan seize this moment, or will it let its startup potential slip away?

The answer lies in execution.